lincoln ne sales tax calculator

There is no applicable county tax or special tax. How do I calculate sales tax.

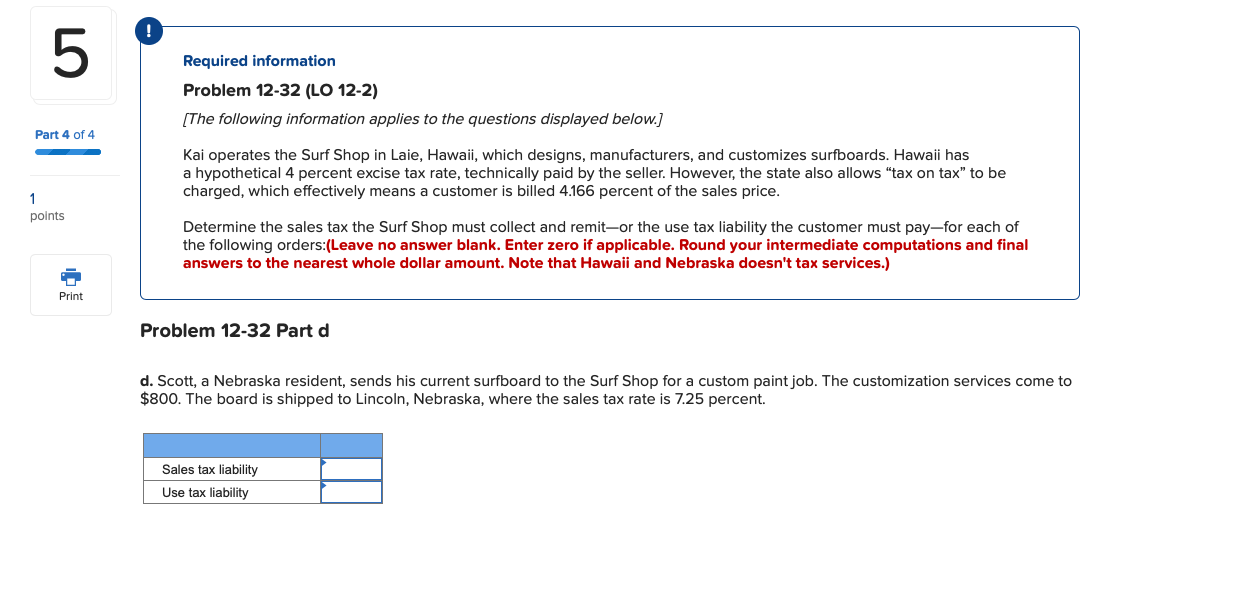

Solved Required Information Problem 12 32 Lo 12 2 The Chegg Com

Name A - Z Sponsored Links.

. Sales Tax Table For Lincoln County Nebraska. Real property tax on median home. Nebraska Sales Tax Rate Finder.

Lincoln NE 68509-4877 Phone. Lincoln Nebraska 68508-3996 8 Q. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

Real property tax on median home. The Lincoln County sales tax rate is. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 583 in Lincoln County Nebraska.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. The Nebraska sales tax rate is currently. The calculator will show you the total sales tax amount as well as the county city.

The December 2020 total local sales tax rate was also 7250. Long-term and short-term capital gains are included as regular income on your Nebraska income tax return. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

That means they are taxed at the rates listed above between. Department of Revenue Current Local Sales and Use Tax Rates. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling.

Method to calculate Lincoln sales tax in 2022. The current total local sales tax rate in Lincoln County NE is 5500. A Base Tax set in Nebraska motor vehicle statutes is assigned to the.

AME Tax Service Sales. The Nebraska state sales tax rate is currently. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

Sales tax in Lincoln Nebraska is currently 725. You can print a 725 sales tax table here. The sales tax rate for Lincoln was updated for the 2020 tax year this is the current sales tax.

Contact the Nebraska Department of Revenue at 402 471-5729 or visit their website at. The 2018 United States Supreme Court decision in South Dakota v. How much is sales tax in Lincoln in Nebraska.

Sales Tax State Local Sales Tax on Food. The December 2020 total local sales tax rate was also 5500. This is the total of state county and city sales tax rates.

Sales Tax Calculator in Lincoln NE. Sales Tax State Local Sales Tax on Food. The current total local sales tax rate in Lincoln NE is 7250.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. Lincoln Sales Tax Rates for 2022.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Nebraska state sales and use tax rate is 55 055.

![]()

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

New Mexico Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Gross Receipts Location Code And Tax Rate Map Governments

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

Taxes And Spending In Nebraska

New Truth In Taxation Postcards Creating Confusion For Property Taxpayers In Lancaster County

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

The Reasons Behind Minnesota S National Property Tax Rankings

The 10 Least Tax Friendly States For Middle Class Families Kiplinger

Nebraska Sales Tax Calculator Reverse Sales Dremployee

General Fund Receipts Nebraska Department Of Revenue

California Sales Tax Small Business Guide Truic