tax shield formula cpa

Calculating the tax shield can be simplified by using this formula. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the weighted average cost of capital WACC.

Modigliani And Miller Part 2 Youtube

The applicable tax rate is 37.

. This reduces the tax it needs to pay by 280000. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give you 3500. Interest Tax Shield Interest Expense Tax Rate.

It also has an option to write off only a minimum amount of 2700. The Tax Shield approach minimizes the tax bills for the taxpayer. Based on the information do the calculation of the tax shield enjoyed by the company.

Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where MPC Marginal Propensity to Consume. Tax Shield Value of Tax Deductible - Expense x Tax Rate Example If a business has 1000 in mortgage interest and its tax rate is 25 then the firm will have a tax shield of 250. Do the calculation of Tax Shield enjoyed by the company.

MPG Marginal Propensity of. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. Or the concept may be applicable but have less impact if accelerated depreciation is not allowed.

For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax shield approach will be worth 200. The formula for calculating a depreciation tax shield is easy. MPI Marginal Propensity to Invest.

MPT Marginal Propensity to Tax. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below.

Example of the. This is equivalent to the 800000 interest expense multiplied by 35. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

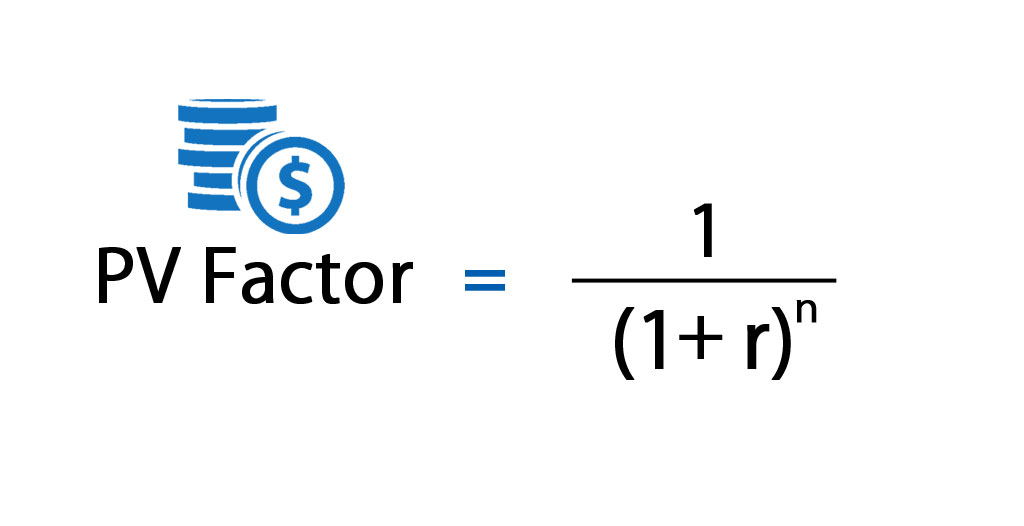

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula. This reduces the tax it needs to pay by 280000. The tax shield Johnson Industries Inc.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. We therefore assume that the firms WACC is 15 the borrowing rate is given above.

The result equals the depreciation tax. CPA COMMON FINAL EXAMINATION REFERENCE SCHEDULE 1. Examples of Taxable Expenses used as a Tax Shield Tax Shield for Individual Expenses.

Thus a tax shield is an amount by which the depreciation and amortization or any non-cash charge lower your income subject to taxation creating cash savings. Tax Shield Amount of tax-deductible expense x Tax rate. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40.

As such the shield is 8000000 x 10 x 35 280000. Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250. As such the shield is 8000000 x 10 x 35 280000.

In this case straight-line depreciation is used to calculate the amount of allowable depreciation. C net initial investment T corporate tax rate. This is equivalent to the 800000 interest expense multiplied by 35.

Calculation of the tax shield follows a simplified formula as shown below. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective income tax rate.

The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Tax Shield formula. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

The maximum depreciation expense it can write off this year is 25000.

How To Calculate Interest Expense The Motley Fool

Current Yield Meaning Importance Formula And More Finance Investing Accounting Basics Learn Accounting

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Present Value Factor Formula Calculator Excel Template

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Operating Cash Flow Formula Examples With Excel Template Calculator

Tax Shield Formula Step By Step Calculation With Examples

How Is Agi Calculated In Tax Universal Cpa Review

Disposable Income Formula Examples With Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

My Savings Journey Planner Sticker Kit Savings Tracker Etsy Money Saving Jar Sticker Kits Planner Stickers

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

My Savings Journey Planner Sticker Kit Savings Tracker Etsy Money Saving Jar Sticker Kits Planner Stickers

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)